RETIREMENT PLANNINGSubTitle

Maximizing Your 401(k): Tips for Long-Term Growth

Retirement Planning 101: Building Wealth for Your Golden Years

Module 1SubTitle

Unlocking the Annuity Puzzle: Why Canadians avoid what seems to be the perfect retirement vehicle

What’s my RRSP contribution limit?

Ask MoneySense

I liked your coverage of RRIF taxation. I would like to see more information on LIF taxation. More precisely, on the following scenario: Individuals do not get the $2,000 tax credit for RRIF withdrawals before age 65. Did I read properly that for LIF withdrawals the $2,000 tax credit applies to anyone, irrespective of age? Meaning under 65? Should a LIRA be moved to a LIF when the expected minimum withdrawal would be under that threshold? Should LIF withdrawals be recommended for anyone under 65 as a tax strategy?.

MUTUAL FUNDSubTitle

Will your travel insurance cover U.S. flight chaos?

The biggest car insurance myths, according to experts

Module 1SubTitle

Unlocking the Annuity Puzzle: Why Canadians avoid what seems to be the perfect retirement vehicle

What’s my RRSP contribution limit?

Trending News

Module SubTitle

September is life insurance awareness month, and a new report from digital insurance provider PolicyMe in partnership with Angus Reid is spotlighting a concerning gap in.

Module SubTitle

The Annuity Puzzle is about a curious phenomenon in Canada: while life annuities sold by insurance companies seem to have all sorts of compelling reasons to acquire them, more often than not, retirees.

World Report

CRYPTOSubTitle

Blockchain Real Estate Solutions: Revolutionizing Property Transactions

INVESTINGSubTitle

Stocks vs. Bonds: Which Investment Strategy Suits You?

INSURANCESubTitle

Will your travel insurance cover U.S. flight chaos?

TAX PLANNINGSubTitle

Crack The Code to Financial Freedom: NPS and PPF Demystified!

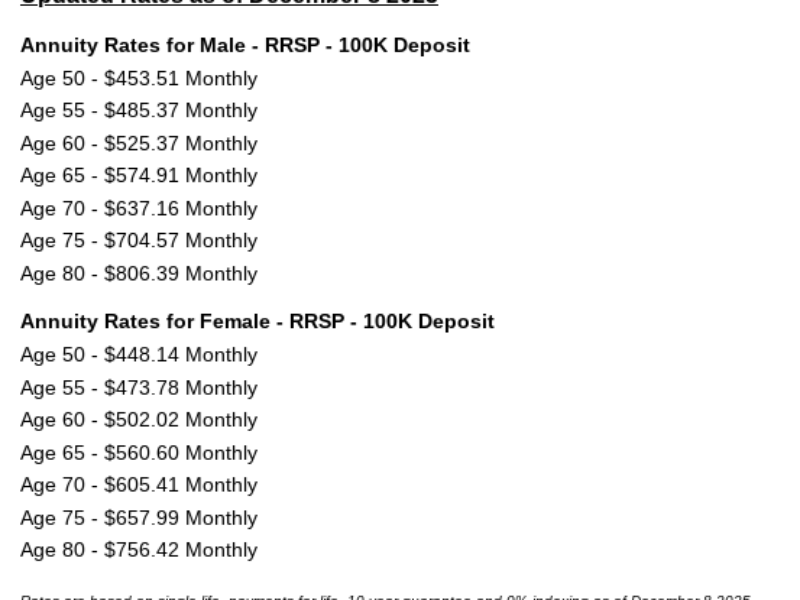

The Annuity Puzzle is about a curious phenomenon in Canada: while life annuities sold by insurance companies seem to have all sorts of compelling reasons to acquire them, more often than not, retirees shun them.

Financial planner Robb Engen recently tackled this puzzle in his Boomer & Echo blog, “Why Canadians avoid one of retirement’s most misunderstood tools.” Engen notes that experts like Finance professor Moshe Milevsky and retired actuary Fred Vettese believe “converting a portion of your savings into guaranteed lifetime income is.

PERSONAL FINANCESUBTITLE

How to Balance Saving and Investing for Maximum Growth

Personal Finance 101: The Basics of Managing Your Money

REAL STATE FINANCESubTitle

Unlocking the Annuity Puzzle: Why Canadians avoid what seems to be the perfect retirement vehicle

What’s my RRSP contribution limit?

Caring for a parent? Get a power of attorney

How to Balance Saving and Investing for Maximum Growth

Emergency Fund vs. Debt Payments: Where Should Your Money Go First?

Unlocking the Annuity Puzzle: Why Canadians avoid what seems to be the perfect retirement vehicle

FINANCEHot News

Unlocking the Annuity Puzzle: Why Canadians avoid what seems to be the perfect retirement vehicle

What’s my RRSP contribution limit?

Caring for a parent? Get a power of attorney

Making the most of the pension tax credit

From RRSP to RRIF—managing your investments in retirement

Financial freedom requires planning and patience. This is the first piece of a series of posts on exploring various investment avenues.

As another year comes to an end, it’s important for us to equip you with the best investment ideas. In this series of articles, we’ll discuss the different routes you can take to plan.

FINANCENews

Unlocking the Annuity Puzzle: Why Canadians avoid what seems to be the perfect retirement vehicle

What’s my RRSP contribution limit?

Caring for a parent? Get a power of attorney

Making the most of the pension tax credit

From RRSP to RRIF—managing your investments in retirement

Module 1SubTitle

Unlocking the Annuity Puzzle: Why Canadians avoid what seems to be the perfect retirement vehicle

What’s my RRSP contribution limit?

Caring for a parent? Get a power of attorney

Making the most of the pension tax credit

investingSubTitle

This story is part 2 in a series on financial caregiving for seniors. Read others in this series:

3 signs you need to take control of your parents’ finances

After the realization set in that I had to take a more active role in managing my parents’ finances, and after my initial scavenger hunt of trying to find any documents I could around their home, my next step was having to interact with a variety of.

The biggest car insurance myths, according to experts

The auto insurance world is rife with misconceptions, experts say, and not knowing fact from fiction could end up costing drivers thousands of dollars.

There are several reasons why insurance myths exist, said Steven Harris, licensed insurance broker and LowestRates.ca expert. “(Insurance contracts) are written in legal terms and it doesn’t always translate into everyday language,” he said. “There can be a little barrier there.”

Harris said people also often assume they’ll be covered against various damages or liabilities, but don’t necessarily know or understand exactly what’s in the policy. A lot of people draw upon personal experiences of friends and family and make decisions based on that, he added.

Here are some of the most common myths.

Red vehicles cost more to insure

The most common question Harris said he comes across.

Term vs. permanent life insurance: How

Is pet insurance worth it in

42% of Canadians don’t have life

How much income do you need

Module 2SubTitle

Unlocking the Annuity Puzzle: Why Canadians avoid what seems to be the perfect retirement vehicle

The Annuity Puzzle is about a curious phenomenon in Canada: while life annuities sold by insurance companies seem to have all sorts of compelling reasons to acquire them, more often than not, retirees shun

The Annuity Puzzle is about a curious phenomenon in Canada: while life annuities sold by insurance companies seem to have all sorts of compelling reasons to acquire them, more often than not, retirees shun What’s my RRSP contribution limit?

Your RRSP contribution limit is the maximum amount you can add to your registered retirement savings plan each year without triggering penalties. It’s based on your unused RRSP deduction room plus 18%

Your RRSP contribution limit is the maximum amount you can add to your registered retirement savings plan each year without triggering penalties. It’s based on your unused RRSP deduction room plus 18% REPORTRead the Latest

Unlocking the Annuity Puzzle: Why Canadians avoid what seems to be the perfect retirement vehicle

The Annuity Puzzle is about a curious phenomenon in Canada: while life annuities sold by insurance companies seem to have all sorts of compelling reasons to acquire them, more often than not, retirees shun them.

Financial planner Robb Engen recently tackled this puzzle in.

Module 7SubTitle

Unlocking the Annuity Puzzle: Why Canadians avoid what seems to be the perfect retirement vehicle

See all Posts →The Annuity Puzzle is about a curious phenomenon in Canada: while life annuities sold by insurance companies seem to have all sorts of compelling reasons to acquire them, more often than not, retirees shun them.

Financial planner Robb Engen recently tackled this puzzle in his Boomer & Echo blog, “Why Canadians avoid one of retirement’s most misunderstood tools.” Engen.

MARKET MOVERS

INSURANCESubTitle

Will your travel insurance cover U.S. flight chaos?

As the U.S. government shutdown leads to thousands of cancelled flights, some Canadian

As the U.S. government shutdown leads to thousands of cancelled flights, some Canadian The biggest car insurance myths, according to experts

The auto insurance world is rife with misconceptions, experts say, and not knowing

The auto insurance world is rife with misconceptions, experts say, and not knowing MUTUAL FUNDSubTitle

Caring for a parent? Get a power of attorney

This story is part 2 in a series on financial caregiving for seniors.

This story is part 2 in a series on financial caregiving for seniors. Making the most of the pension tax credit

Ask MoneySense I liked your coverage of RRIF taxation. I would like to see

Ask MoneySense I liked your coverage of RRIF taxation. I would like to see REAL STATE FINANCESubTitle

What’s my RRSP contribution limit?

Your RRSP contribution limit is the maximum amount you can add to your

Your RRSP contribution limit is the maximum amount you can add to your Caring for a parent? Get a power of attorney

This story is part 2 in a series on financial caregiving for seniors.

This story is part 2 in a series on financial caregiving for seniors. MUTUAL FUNDSubTitle

Caring for a parent? Get a power of attorney

This story is part 2 in a series on financial caregiving for seniors.

This story is part 2 in a series on financial caregiving for seniors. Making the most of the pension tax credit

Ask MoneySense I liked your coverage of RRIF taxation. I would like to see

Ask MoneySense I liked your coverage of RRIF taxation. I would like to see