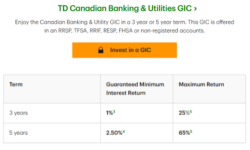

The first month of a new year tends to bring a familiar checklist for Canadian investors. There is fresh tax-free savings account (TFSA) contribution room to use. For 2026, that number is $7,000. There is also the annual rush to finish topping up registered retirement savings plan (RRSP) contributions within the first 60 days for […]

Retirement planning seems to involve waging a battle between the extremes of running out of money before you run out of life, or running out of life before you run out of money. The latter possibility rarely seems to occur to people but was aptly described by FIRE blogger Bob Lai of Tawcan in a […]

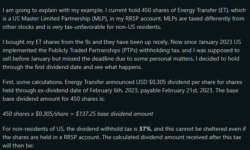

For better or worse, a sizable group of Canadian investors still screens prospective investments by dividend yield. When that search expands beyond Canadian stocks, it often leads into parts of the U.S. market that look attractive on the surface but are poorly understood. Common examples include American mortgage real estate investment trusts (mREITs) and business […]

In Canada, most retirement plans include the Canada Pension Plan (CPP). Whether retirement is just around the corner or still years away, CPP is likely to form part of your retirement income. How much you receive depends on factors such as your earnings history, contributions, and when you start collecting benefits. This guide answers common […]

The Annuity Puzzle is about a curious phenomenon in Canada: while life annuities sold by insurance companies seem to have all sorts of compelling reasons to acquire them, more often than not, retirees shun them. Financial planner Robb Engen recently tackled this puzzle in his Boomer & Echo blog, “Why Canadians avoid one of retirement’s most misunderstood tools.” Engen […]

Your RRSP contribution limit is the maximum amount you can add to your registered retirement savings plan each year without triggering penalties. It’s based on your unused RRSP deduction room plus 18% of your previous year’s earned income, up to the annual CRA limit. Use our RRSP contribution limit calculator below to find your exact […]

This story is part 2 in a series on financial caregiving for seniors. Read others in this series: 3 signs you need to take control of your parents’ finances After the realization set in that I had to take a more active role in managing my parents’ finances, and after my initial scavenger hunt of […]

Ask MoneySense I liked your coverage of RRIF taxation. I would like to see more information on LIF taxation. More precisely, on the following scenario: Individuals do not get the $2,000 tax credit for RRIF withdrawals before age 65. Did I read properly that for LIF withdrawals the $2,000 tax credit applies to anyone, irrespective of […]

Retirement brings many changes in a person’s life and your investment portfolio is one of them. Tracy Andrade, a wealth adviser and certified financial planner at Marnoa Private Wealth Counsel, says it’s challenging for people to see their savings start to decline as they begin spending their nest egg. “That’s the biggest mental mind shift that […]

Ask MoneySense My dad is 77 years old and we live together in a house worth $840,000, which we own together. Dad retired at age 70 and commuted his pension so he would have money to leave to me. He has about $580,000 divided between a LIF and a RRIF and his CPP is $17,000 […]